Automate Your Savings: Open a BPI Save-Up Account

In the one year that we’ve been trying (really hard, I must say) to get our finances right, I must say that the very beginning is almost always the hardest. This also applies to anything and everything else in life, if you haven’t noticed that.

We’ve followed a slightly reverse path when it came to building our financial foundation and, so far, we’re stuck with the very basic and most important of all: emergency funds. Dave Ramsey suggests automating all things money in your life because that way it becomes easier to let go.

Not ever getting hold of money in the first place will make it less harder to allocate for the more important stuff such as for your emergency fund, retirement fund, child’s college fund, investment and so on.

The sad thing about living in the Philippines though is that there are not as much options in many things as there is in the US. I’ve searched for automated savings, for example, among Philippine banks and I’ve only come up with Citibank and BPI. Citibank would have been favorable for me but our company changed payroll banks just very recently and I could not afford the 100K PHP minimum amount to maintain a Citibank savings account just yet. We switched to BPI (I also opened a personal savings account there a year ago) which was fortunate. Enough about the intro though.

BPI has a BPI Direct Save Up program which allows you to automatically transfer money from your payroll or personal savings account to the save-up account. It’s hassle-free since you do not have to withdraw and then deposit in another account. Plus, you can automate and schedule it (at least 1000PHP every month or every two weeks, depending on your preference) so allocating a part of your monthly pay becomes as natural as breathing.

Opening a save-up account only takes about three business days and you can monitor your funds through your BPI Express Online account. Yay! Oh, and it also comes with free insurance so it’s like hitting two birds with one stone.

RELATED READS

The only disadvantage is that transferring money from the Save-Up account to your payroll or personal savings account can also be done with just a few clicks (just as easy as saving) so you may have to fight the temptation to withdraw your save-up funds.

But, the good thing is that it could only be done online so make sure you don’t transfer ahead of time before going out and while you still have Internet access.

I’m not sure if it is possible to transfer money using their phone app or mobile site but just to be on the safe side, do not install apps on your phone or avoid using WiFi and mobile data altogether. Also stay away from BPI branches because they have kiosks that allow you to go online. Haha.

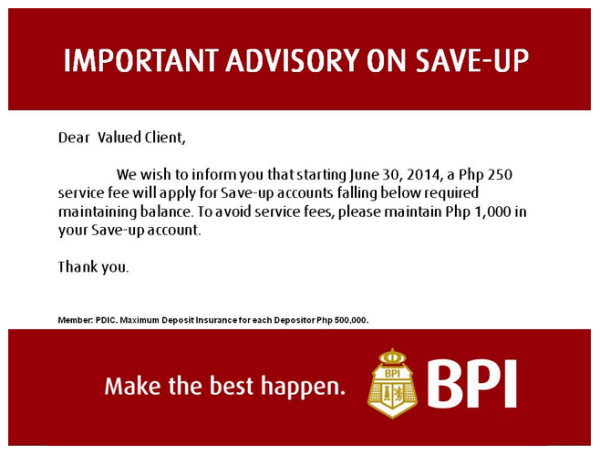

Kidding aside, Save-Up is a really great program to get you started with saving for the rainy days. They have also recently implemented a 300PHP 250PHP fee for accounts that go below the 1000PHP average daily balance. To start saving:

- Complete this online form.

- Enter you login credentials at the BPI Express Online’s login page.

- The BPI Direct Save Up page will then be displayed.

- Nominate a source account. This is the account where the money will be transferred from to your Save-Up account. You may choose any of the enrolled that you have with BPI Express Online.

- Provide details for the Authorization for Automatic Scheduled Remittance or Funds Transfer Arrangement. You can designate as low as 250PHP transfer every week, every other week, once a month or twice a month – whichever is most convenient for you. Of course, you may also do the funds transfer manually.Personally, I just use manual transfer since I forgot the transfer schedule I designated and I don’t usually put funds in my personal BPI account (for now haha). Again, it’s possible to do manual transfer from any of the accounts you enrolled in your BPI Express Online account.

- Also provide an initial transfer date. The earliest initial transfer date should be at least four (4) banking days but not later than 60 calendar days from date of this instruction.

- OPTIONAL. Provide a cellphone number (one enrolled in BPI Express Mobile) so that the BPI Direct Save-Up account could also be enrolled in this facility.

- Tick the checkbox to confirm that you agree with the Terms and Conditions.

- Click on the Submit button.

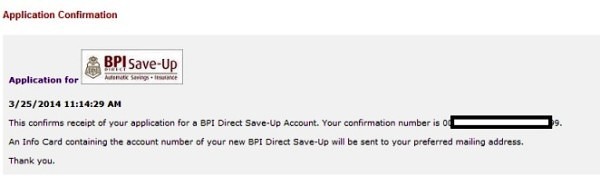

- You will see this on your screen as well as receive a confirmation email regarding your application.

It took my account about three days, I guess, to be activated. They did not send an email about it though so I just checked my BPI Express Online account from time to time.

That’s it.

Happy saving, everyone!

XX

UPDATE: I never got my BPI Save-UP info card although it doesn’t mean you can’t use your account. It will probably be used for the insurance though.

About the Author

Pam is an outdoors-loving millennial momma who loves to hike, trek and camp in the beaches and mountains with her partner and their 3-year-old daughter. When not exploring the great outdoors, she moonlights as a freelance writer specializing in the travel, parenting, personal finance and digital marketing niches. You can also follow her via social media: Facebook, Twitter, Instagram and Pinterest!

Have you tried transferring fund from your BPI Save up to your regular BPI account? madali lang ba?

Do I need to go personally to any BPI branch to set up the Saved-up account or the card is virtual or can be any existing savings account?

Hey Jennylyn. Everything was done online. I unfortunately didn’t receive any card but the account was added to BPI online. 🙂

Is it possible to reschedule the autotransfer?

I don’t personally follow the autotransfer sched (I forgot) but I do manual transfer instead. I’m not sure how to change it though.

Thank you for this!(: