Things We Learned as A First-Time Homeowner

Buying and owning your very own property is no walk in the park. There are a lot of things to consider: from researching properties, preparing documents to making monthly payments.

While I love checking off items from my list, I hated having to go through the small items required to accomplish the bigger goals. It took us three years to get to finally moving in, but even so, we found the entire home buying process to be very exhausting — and we already had the help of the real estate developer.

Here are just some of the most important things that we learned as first-time homeowners — and we hope these things will make the process a whole lot easier for you.

1. Find a good agent or real estate developer.

Our current home was not exactly our first choice. We had initially opted to get a unit from a socialized housing project at just Php 500,000 in the hopes of just paying less than Php 5,000 per month on mortgage. Things turned sour quickly — and we should have known right at the very beginning. The fact that the real estate developer had only less than five papers for me to sign in upon handing over our reservation fee should have already been a red flag or that they couldn’t issue an official receipt when we paid our third equity payment.

Long story short, our nearly Php 20,000 investment was gone with the wind. Apparently, the developers had issues and while we really feel sorry for the other homebuyers who had been able to pay off the entire amount, we weren’t very hopeful when it came to legally chasing for our money.

If you ever decide on getting your own property, be sure to research on the developer. The more papers you have to sign upon paying for the reservation fee, the better. It’s also a huge plus if you go for a trusted real estate agent who can guide and motivate you through the whole process.

2. Know how much you can afford.

Although you cannot get approved for loans unless you reach a certain income bracket, it is actually possible to still not be able to afford your house even if you’ve been approved. Case in point: our new monthly equity payments were already twice the amount I had originally budgeted for.

Add to that was the fact that our rowhouse unit was already nearing completion. In the Philippines, developers are required to submit papers to Pag-ibig upon turnover so that they buyers could already start processing their loan applications. Thus, two months after starting our monthly equity payments, we also had to wrestle with our mortgage repayments, which was nearly the same amount.

By this time, we had no choice but to be very creative in how we earn and spend money. It wasn’t without setbacks: we shifted into becoming a single-income, freelancing household, “forgot” to pay our mortgage for seven months and nearly had our (sort of) property foreclosed. That happened even before we got to set foot inside but that’s another story to tell.

3. Know what you want.

Sure you’re on a budget but it certainly doesn’t mean that you can’t get what you want. You could still get some items checked off the list…maybe.

My dream house is really a huge ranch with a farm house in the middle but a rowhouse works – at least for now. When we handed over the payment for the reservation fee, we chose a slightly bigger lot (a small strip of land enough to fit a single bed costed us Php 100,000 more!) and one that had no neighbors across. We realized, four months in, that it was the perfect spot for our introverted family!

4. Plan for the unexpected.

You might not realize it but three years is a long time to be paying for anything. Much has changed since we started our homeowning journey and we definitely have been through a lot.

We’ve ditched corporate jobs, switched to a single income household, freelanced and found side hustles, incurred other debts (because paying for a Php 1million loan for 30 years ain’t enough haha), backpacked for almost a month, and even added a new member to our family.

Our journey isn’t really one to emulate mostly because we didn’t set aside extra funds for the unexpected. Fortunately for us, things still fall into place although, admittedly, it has been one exhausting ride and we are just two months shy from finishing off our equity. Php 350,000 in 3 years is no easy feat!

5. Moving in is only the beginning.

Then again, signing contracts, attending seminars, completing documents, opening a checking account (so adult!) and paying off one fee after another is really just the cream of the crop, so to speak. Yep, it’s actually the easiest part of them all.

We would have waited a bit more before moving in because money was tight but when we found out that a baby was on the way, we had to make it happen. Honestly, it was such a huge hurdle, it was almost demotivating. We had to settle our Pagibig loan first (had it restructured) and paid off a slightly huge amount. Then there was real estate taxes (adulting couldn’t get any more real), move-in fees, water and electrical connection fees — the list seemed endless!

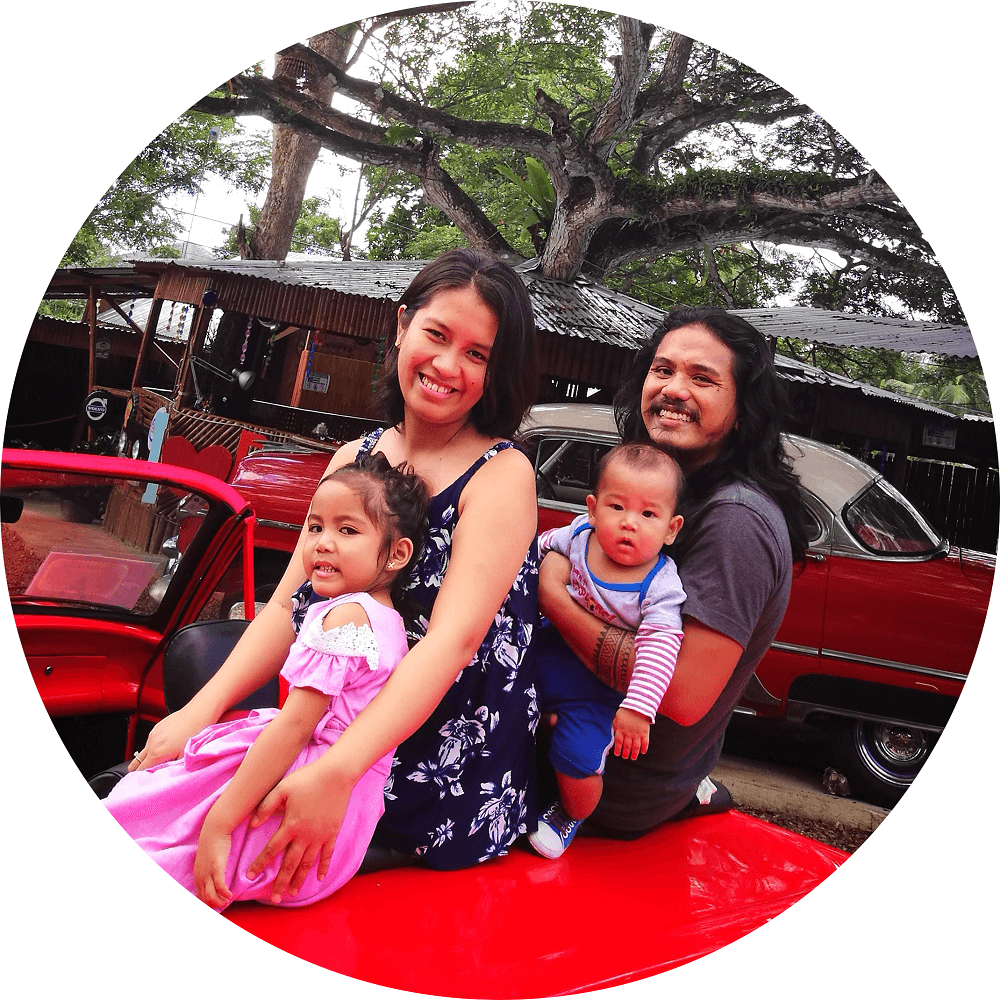

But finally, we made it and I’m here typing this article in our huge borrowed plastic table while the two kiddos sleep on the mattress on the floor while the partner is out buying groceries. It has been almost five months since we first slept in our tiny-ish house and it has been a great adventure.

Moving in is only the beginning and there’s more bills to pay, unfortunately. So while I am a huge fan of “going in while you’re scared” and “not waiting for the perfect moment because it won’t ever come”, having a solid financial plan right at the very beginning can really go a long way.